Download this IELTS Speaking Lesson PDF

In this IELTS Speaking lesson on personal finance, you will learn different vocabulary to talk about finances, how you use money and the challenges of using them. You will also learn some useful idioms and practice your pronunciation so you can speak confidently on this topic.

Table of Contents

IELTS Speaking Vocabulary: Money and Finance

“Financial literacy is the confident understanding of concepts including saving, investing and debt”

Here is some useful vocabulary to talk confidently on the IELTS Speaking topic of Money and Personal Finance

- A budget (n.)

I make a monthly budget

I live on a budget of 500 USD per month

- To go/be over budget = to spend more than you planned

I have gone over budget this month

- To budget (v.) = to allocate money for something

I will need to budget for a new kitchen this year

- budget (adj.) = cheap, economical, low price

We have booked a budget hotel

To save (for retirement)

- To keep money

To save up

I am saving up to buy a new laptop

I am saving up for a new car

2. To spend less

If you buy in bulk (=buy a lot at one time) you save money

*****

To invest (in something) (v.)

I like to invest in stocks and shares

I invest a lot of time and energy in learning English

- Investment (n.) Countable or uncountable

- An investor (person)

*****

To earn money

To make money

Have a salary (monthly payment)

Have a wage (weekly payment)

*****

Finance (n.) uncountable

Financial (adj.)

planning

security

freedom

literacy

IELTS Discussion: Investments

An investment is where you buy something and you expect to grow in value. Here are some things to consider when talking about investments.

High risk versus low risk

Long-term versus short term

Volatile versus stable

A key guiding principle of investing is the following:

“Only invest money you can afford to lose”

Investing is about risks and here are some more related collocations:

- Take calculated risks

- Manage the risk well

- Balance high risk and low risk investments

Get a good return on your investment (ROI)

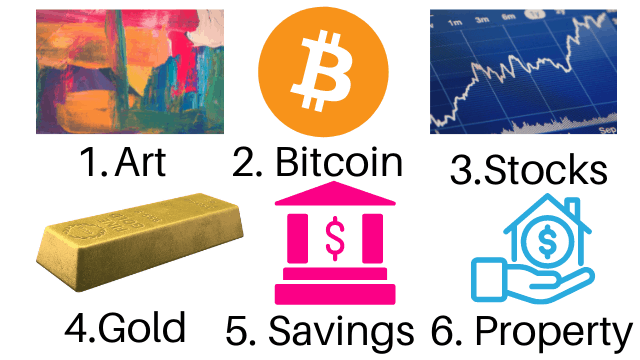

Which is the best investment?

- Works of Art

- Cryptocurrencies (e.g. Bitcoin)

- Stocks

- Gold

- Savings account (bank)

- Real Estate (property / houses)

I think gold is a safe haven and a good store of value

Stocks are fairly stable and can pay off in the long term

You make a quick win with cryptocurrencies, but it is a volatile market

I would invest in real estate because it tends not to depreciate (=fall in value)

A saving account is stable but the interest rate is so low. That said, it could be a good long-term investment.

IELTS Speaking Idioms about Money and Finance

To be on a shoestring budget = with little money to spend

To be on a tight budget = with little money to spend

To tighten your belt = to be careful with spending money

We don’t have much money, so we need to tighten out belts this month.

To make ends meet = to cope, survive (financially)

It’s hard to make ends meet at the end of the month

To be hard up = to have little money

(temporarily)

I’m a hard at the moment and can’t afford to go to the pub

To be broke = to have no money left

To get by = to cope, survive

I can get by until my next pay cheque

A juggling act = something that is difficult to balance

Controlling monthly budgets is a juggling act

Once bitten, twice shy! = A proverb meaning when you try something for the first time and it doesn’t work, the second time you are less likely to try it.

More Free Lessons

If you liked this lesson, leave a comment below!

There are more lessons you can follow in the links below too.

Q&A in IELTS Speaking. Questions about exam technique, how to learn English, and how best to prepare.

BUSINESS in IELTS Speaking. Useful vocabulary and idioms to express yourself when talking about Business.

JOBS in IELTS Speaking. Vocabulary you need to answer questions in Part 1, 2 and 3 for the topic of jobs.

It is extraordinary lesson where we learned lots of things about personal finance thank you ever so much our glorious teacher

My pleasure – glad you liked the lesson.